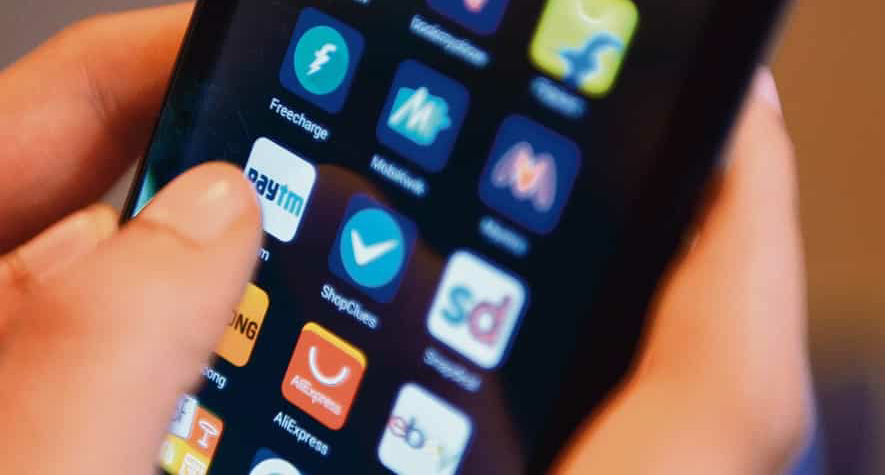

Top 5 secure and user-friendly payment apps: Google Pay, PhonePe, and others

Paytm, the fintech company headed by Vijay Shekhar Sharma, has faced a tumultuous year in 2024. After being barred from adding new customers some time ago, the Reserve Bank of India has now directed the company to halt all wallet services. Despite being granted permission to function as a third-party UPI provider, many Paytm users are already seeking alternative payment options. If you are one of them, consider exploring the top 5 payment apps for secure and convenient transactions, such as Google Pay, PhonePe, and others. 5 Best Apps for…

Read More