Paytm Reports Robust EBITDA before ESOP of ₹84 Cr in Q1FY24

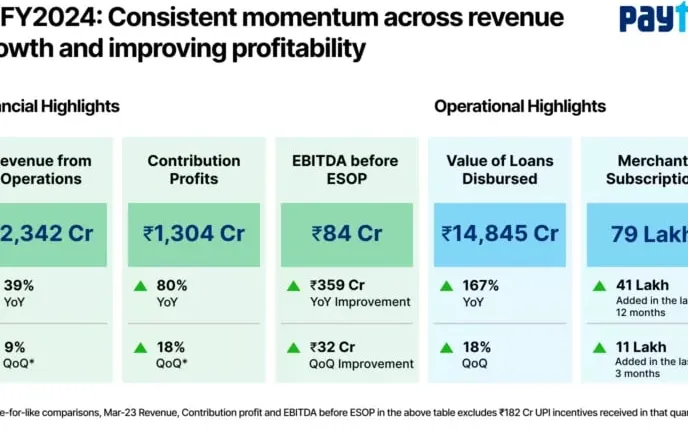

Paytm, the top payments and financial services company in India and the innovator behind QR and mobile payments, has released its Q1FY24 results. The company has witnessed a significant enhancement in EBITDA before ESOP cost, with ₹84 Cr compared to ₹275 Cr in Q1 FY 2023. Additionally, Paytm’s revenue from operations has experienced a YoY growth of 39%, amounting to ₹2,342 Cr.

The company’s EBITDA margin before ESOP margin was 4%, which was due to the continued increase in profitability due to strong revenue growth, increasing payment margin and operational leverage. This does not include UPI incentives as it recorded the UPI incentives after the announcement by the government, which is usually in the second half of the financial year (H2). It managed to increase EBITDA and continue investing in growth.

It has seasonality in indirect expenses with marketing expenses increasing in the first quarter due to IPL and personnel expenses increasing due to evaluations. In the coming quarters, Paytm expects its continued peak growth and operational leverage to increase profitability. In the fourth quarter of FY2023, it reported EBITDA before ESOP of ₹234 Cr, including UPI incentive of ₹182 Cr for FY2023. The company’s EBITDA before ESOP is ₹84 Cr compared to ₹52 Cr in Q4 FY2023 UPI accrual.

The company’s strong growth rate continues, which is supported by the increase in merchant subscription revenues, the increase in merchant payment volumes (GMV) and the increase in loan payments. Paytm’s payment revenue grew 31% YoY to ₹ 1,414 Cr, while payments profitability improved with net payment margin rising 69% to ₹ 648 Cr.

Paytm’s net payment processing margin has improved further and is now in the upper end of 7-9 bps due to increasing share of UPI instruments at the points of sale and focus on EMI processing through credit and debit cards of other banks and lower switching costs for postpaid, wallet and other payment instruments. In Q1FY24, the company’s GMV grew 37% YoY to ₹ 4.05 lakh crore.

Financial services and others revenue grew 93% year-on-year to 522 Cr in Q1 2024 as Paytm continues to expand its credit business. The total number of unique borrowers who have taken loans through its platform has grown by 49 lakhs to Rs 1.06 Cr over the past year. Loans disbursed through the Paytm platform grew to ₹ 1.28 crore, up 51% YoY, while the value of loans disbursed grew to ₹ 14,845 crore, up 167% YoY across its three product lines – Paytm Postpaid, Personal Loans and Merchant Loans. Paytm disburses loans in collaboration with marquee lenders and has taken on Shriram Finance as a new loan partner.

The company continues to monetize Paytm app traffic in its Commerce and Cloud segment by offering marketing services to its merchants. In the first quarter of 2024, its Commerce & Cloud revenues grew by 22% YoY to 405 Cr. to ₹. Thanks to growth in net disbursement margin and loan distribution income, Paytm’s disbursement profit of 1,304 Cr represents an 80% year-on-year growth, while disbursement margin improved to 56% from 43% a year ago.

Paytm’s subscriber base has grown strongly, almost doubling in the last year, while its merchant base has grown to 3.6 Cr. The company’s leadership in payments monetization continues with 79 lakh devices, both Soundbox and Paytm Card Machines, adding 41 lakh yy and 11 Lakh QoQ. As adoption of digital payments continues for consumers and merchants in India, user engagement on the platform continues to grow. Average Monthly Transactional User (MTU) is 9.2 Cr, up 23% YoY.